tax saver plan phone number

Self-employed individuals may claim these credits for the period beginning on. Youll need your Online Saver account number and sort code well send this to you once your Online Saver is open together with the amount youd like to deposit.

Taxsaver Plan Your Satisfaction Is Our Success

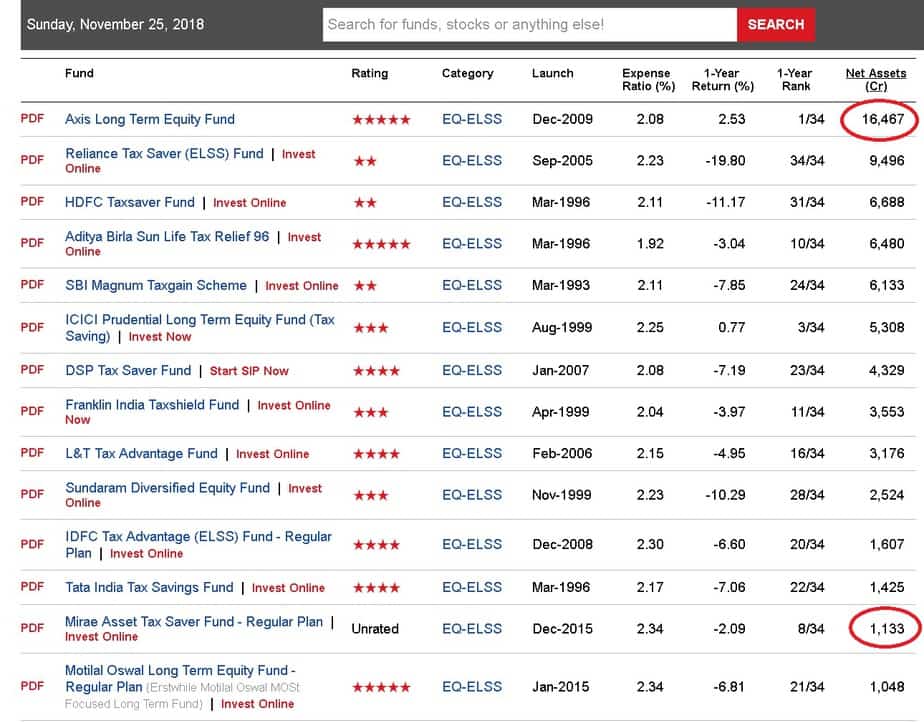

DSP Tax Saver Fund - Direct Plan 4 Value Research 16454 181-16454 DSP Mutual Fund The scheme seeks to generate medium to long-term capital appreciation from a diversified portfolio that is substantially constituted of equity and equity related securities of corporates and to enable investors avail of deduction from total income as permitted under the income tax act.

. Current tax rate is 10 if your total long term capital gain exceeds 1 lakh in a financial year. Name Age Gender. You will receive your order by mail usually within 10 days.

Invest as small as 10000. Connect with us. To qualify for the credit in.

Invest In MC 30. The Invest-Saver plan must be purchased in cash after opening Multiplier or Cashback Bonus. You may also roll over any part of a distribution from a 403b plan by converting it through a direct rollover described below to a Roth IRA.

The American Rescue Plan Act of 2021 enacted on March 11 2021 ARP provides that certain self-employed individuals can claim credits for up to 10 days of paid sick leave and up to 60 days of paid family leave if they are unable to work or telework due to circumstances related to coronavirus. Investment transactions will be recognised as the Singapore dollar equivalent at DBS prevailing exchange rate. Your Invest-Savers monthly contribution amount will be recognised for the first 12 consecutive contributions per investment fund.

Exide Life Star Saver offers guaranteed tax free maturity benefit along with comprehensive protection over the entire policy term. Flexible interest pay out monthly quarterly or reinvestment in principal. Next Blog The clarity on deducting TDS when making payments under GST has complic.

The fund has an expense. DSP Tax Saver Direct Plan-Growth has 9856 Crores worth of assets under management AUM as on 31122021 and is medium-sized fund of its category. Conversion amounts are generally.

Dual benefits of attractive interest rates and tax saving. Get tax deduction up to 150000 under Section 80C. Employee Contributions to Retirement Plans.

Any cesssurcharge is not included. Previous Blog TDS is deducted 10 on EPF balance if withdrawn before 5 years of ser. Track your portfolio 24X7.

Post Office Online Saver is open to. If you open a new AMP SuperEdge Saver Account and you have not held an AMP SuperEdge Saver Account in the last two years youll earn a bonus of 035 pa on top of the AMP SuperEdge Saver Account Standard Rate during the Bonus Period. However you can claim a deduction on your taxable income.

For example the tax app will automatically calculate Savers Tax Credit if you qualify for it. You can generally roll over tax free all or any part of a distribution from a 403b plan to a traditional IRA or a non-Roth eligible retirement plan except for any nonqualifying distributions described later. Rollover contributions from an existing plan do not qualify for the credit.

The Bonus Period begins the first day of the month after the account is opened and is active for six months. Canara Robeco Equity Tax Saver Direct- Growth returns of last 1-year are 1996. There are four types of contributions that employees can make to retirement plans.

This fund has been in existence for 9 yrs 1 m having been launched on 01012013. Tax agent phone services Fast Key Code guide. Know before you invest.

In an event of death of the policyholder the death benefit proceed will be higher of total premiums received upto the date of death accumulated at an interest rate of 025 pa. The fund has an expense ratio of 074 which is less than what most other ELSS funds charge. These changes are an increase from last years Child Tax Credit benefit of 2000.

Compounded annually plus vested simple reversionary bonus plus terminal bonuses if any or 105 of total premiums received upto the date of death will be paid to the beneficiarynominee. Internal transfers from an eligible Post Office savings account subject to the terms of that account can be made by logging into our online servicing site. MC30 is a curated basket of 30 investment-worthy.

The Bonus Rate is payable. Under the American Rescue Plan Act of 2021 the new Child Tax Credit is a refundable credit worth up to 3600 per qualifying child under 18. Canara Robeco Equity Tax Saver Direct- Growth has 3209 Crores worth of assets under management AUM as on 31122021 and is medium-sized fund of its category.

Fast Key Codes allow you to key ahead to the option. You can call 1-800-TAX-FORM 1-800-829-3676 Mondays through Fridays 7 am. You can contribute to your retirement account through your employer andor on your own.

Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes. The Savers Credit is based on contributions to a qualified retirement plan including a traditional or Roth IRA 401k 403b 457b SIMPLE plan SARSEP 501c18D plan and contributions made to an ABLE account for which you are the designated beneficiary. Save 46800 on taxes if the insurance premium amount is Rs15 lakh per annum and you are a Regular Individual Fall under 30 income tax slab having taxable income less than Rs.

Nippon India Tax Saver ELSS Fund - Direct Plan 1 Value Research 16186 24-16186 Nippon India Mutual Fund The scheme aims to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. Also called salary reduction. Local time except Alaska and Hawaii which follow Pacific time to order current year forms instructions and publications as well as prior year forms and instructions by mail.

1 Elective Deferral Contributions. DSP Tax Saver Direct Plan-Growth is a ELSS mutual fund scheme from DSP Mutual Fund. Minimum investment of 10000 and maximum of 150000 for a duration.

50 lakh and Opt for Old tax regime Save 54600 on taxes if the insurance premium amount is Rs15 lakh per annum for life cover and 25000 for critical illness cover and you are a Regular. You can use this tax agent phone services Fast Key Code guide to find the right phone number for the topic you need to phone us about.

Taxsaver Plan Your Satisfaction Is Our Success

What Is Tax Island Saver Moneysense Money Saving Plan Money Activities How To Plan

Scripbox Tax Saver The Best Tax Saving Plan Best Tax Saver Elss Mutual Funds Scripbox In 2021 Mutuals Funds Savers Where To Invest

Mirae Asset Tax Saver Fund Looking For An Elss Fund Away From The Crowd

Free Budget And Credit Score Tracker With Cash Rewards Status Money Credit Score What Is Credit Score Managing Your Money

Taxsaver Plan Your Satisfaction Is Our Success

Investment In Tax Saver Fds Generates Assured Returns With Safety In This Post I Have Listed The Best Tax Saving Fd Rates O Safe Investments Investing Savers