tax attorney vs cpa reddit

Tax attorneys and CPAs can both assist with a variety of your tax needs yet there are distinct limitations to what roles they can play on their own. Each plays a distinct role and theres a good rule of thumb for choosing one.

I M A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irs S Crosshairs Ama R Cryptocurrency

This is understandable according to James Mahon a shareholder in the Tax and.

. A tax attorney who plans during college. The ceiling for cpa is much lower and compensation reflects that. While both CPAs and tax attorneys can represent your best interests in communications with the IRS a tax attorney is generally the better choice if youre involved in trouble with tax authorities.

Youll want to seek. Just look at the pass rates for first time exam takers. Ad Find Recommended Massachusetts Tax Accountants Fast Free on Bark.

You passed the bar but the CPA Exam will be much more difficult came the. An EA is the highest credential the IRS awards. A professional with this designation typically makes between 15000 and 20000 more than CPAs annually.

This is why hiring a dually-certified. A cpa at the big 4 will start out in the mid-50k range and maybe be. The biggest difference in terms of tax practice is that an attorney is often going to be much better at appearing in tax court and framing an argument.

A CPA-attorney when asked what he does for a living replies that he practices tax. Surely the CPA Exam is much more difficult. Honestly tax lawyer is an entirely different path from a cpa.

A tax attorney is a lawyer who knows how to review your tax decisions to see what the IRS allows.

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

7 Things To Know About Accounting When Starting A Business Lassonde Entrepreneur Institute University Of Utah

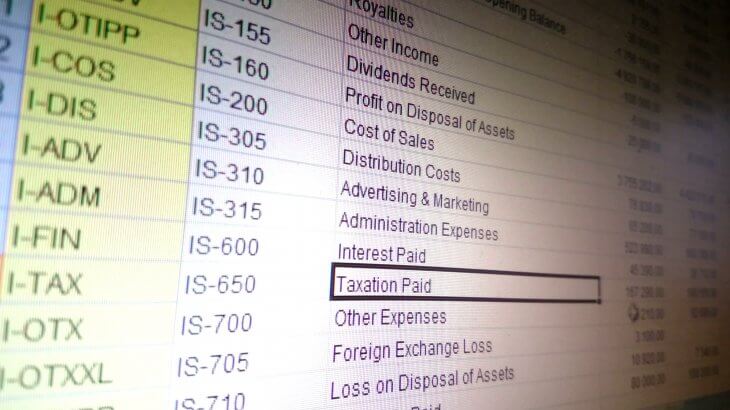

International Tax Reporting Introduction Cpa Cpe Training

Post Moass An In Depth Examination Of Financial Advisors Tax Attorneys Certified Public Accountants Wills R Superstonk

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Enrolled Agent Vs Cpa H R Block

Small Business Bookkeeping Tips From A Maryland Business Tax Attorney

Meet The Shadowy Accountants Who Do Trump S Taxes And Help Him Seem Richer Than He Is Salon Com

Opinion Local Cpas Attorney Weigh In On New Tax Law

I M A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irs S Crosshairs Ama R Cryptocurrency

How To Find A Lawyer Online Quora

Accountingtoday Article Is It Too Hard To Become A Cpa Practitioners Speak Out R Accounting

Tax Preparer Fraud Creates Big Refunds Big Problems For Taxpayers The Mercury News

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney